a limited-pay life policy has quizlet

Rob purchased a standard whole life policy with a 500000 death benefit when he was age 30. How long does the coverage normally remain on a limited-pay life policy.

Solved Roll Over The Items To Read The Statements Drag The Chegg Com

Mike and Ike are 30 year old identical twins.

. Renewable Term to Age 100. Study Life Policies flashcards from Tevin Perezs class online or in Brainscape s iPhone. In this situation the death benefit would be the 500000 face amount 11.

Straight Whole Life D. As a mandatory policy rider. Insurers offer several limited pay policies including.

Insurance companies can charge an interest rate based on the policyowners credit report. Metab 2 Final Review. A an opportunity to refuse the dissemination of the information.

Once you reach the target years or age premiums are no longer required but the policys benefits lasts the insureds entire life. Cash value still equals face amount at age 100 policy maturity Limited-Pay and Single-Premium Whole Life. Mike buys a 10-year renewable term policy.

Level-premium insurance is a type of term life insurance for which the premiums remain the same throughout the duration of the contract. 10 yr renewable life paid up to age 70 st8 whole life renewable term to 100. If purchased at age 30 paid up at age 50.

Cash value builds faster than ordinary straight whole life. A Limited-Pay Life policy has. The present cash value of the policy equals 250000.

The premium paid on this type of policy will be higher at. Graded death benefits B. His insurance agent told him the policy would be paid up if he reached age 100.

The insurer can make policy charges without difficulty. A Limited pay life insurance policy has a set period in which you pay premiums into the policy either for a number of years or to a specific age. 15 Questions Show answers.

A Limited-Pay Life policy has A. A policyowner has a life insurance policy where she had listed her age on the application as 5 years younger than her actual age. Life paid up to age 70.

Premium payments limited to a specified number of years. 10-year Renewable and Convertible Term B. Life Paid-Up at Age 70.

If the insurer wishes to share an applicants HIV status the applicant must be given full notice of all of the following EXCEPT. No cash value C. Each brother purchases a life policy that has a 750 annual premium.

Jay is issued a life insurance policy with a death benefit of 100000 she pays 600 per year in premium for the first five years the premium then increases the 900 per year in the 60 year and remains level there after the policies death benefit also remains at 100000 which type of life insurance policy is this. As a nonforfeiture option. The correct answer is.

Life Paid-up at Age 65 4. PSI online exam Life Insurance. Which of these would be considered a Limited-Pay Life policy.

Life Paid-Up at Age 70 C. Renaissance and reformation test. Level Term Life 2.

A life policy with a death benefit that can fluctuate according to the performance of its underlying investment portfolio is referred to as. A life insurance policy which contains cash values that vary according to its investment performance of stocks is called. Expires at the end of the policy period.

All of the following statements are true EXCEPT. Ike purchases a whole life policy. A 20-Pay Life will be paid up in 20 years 20 PL Limited-Pay and Single-Premium Whole Life.

The family policy is a combination plan that provides insurance protection under one contract to all members of your immediate family husband wife and children. A straight life b life paid-up at age 65 c renewable term to age 70 d endowment maturing at age 65. A Mikes policy will develop no cash value over the policys term.

Rob purchased a standard whole life policy with a 500000 death benefit when he was age 30. Renewable Term to Age 70. Which of these would be considered a Limited-Pay Life policy.

B insurers practices with respect to the treatment of this information. Limited pay whole life policies grow cash value faster than ordinary straight whole life policies because the premium paying period is restricted to a limited number of years. Which of the following is an example of a limited-pay life policy.

Usually family policies are sold in units packages of protection such as 5000 on the main wage earner 1500 on the spouse and 1000 on each child. As an optional policy rider. Premiums are fixed for the first 5 years.

S dies 5 years later in 2008 and the insurer pays the beneficiary 10500. As a provision of the policy. S buys a 10000 Whole Life policy in 2003 and pays an annual premium of 100.

Both are in excellent health. In this example the premium paying period is restricted to 25 years. The death benefit would be 250000 750000 375000 500000.

Paid-up at 65 20-pay life 30-pay life Straight whole life. What type of policy would offer a 40-year old the quickest accumulation of cash value. The policy owner can make policy changes without difficulty.

Term insurance has which of the following characteristics. An advantage of owning a flexible premium life insurance policy would be. Past-due interest on a policy loan is added to the total debt.

Limited-Pay and Single-Premium Whole Life. As an optional policy rider. Age 100 20 A term life insurance policy matures upon the insureds death during the term of the policy Decks in Insurance Class 3.

Rob recently died at age 60. When the insured purchased a new home he wanted to purchase a life insurance policy that would protect his family against losing it should he die before the mortgage was paid. Which of the following is an example of a limited-pay life policy.

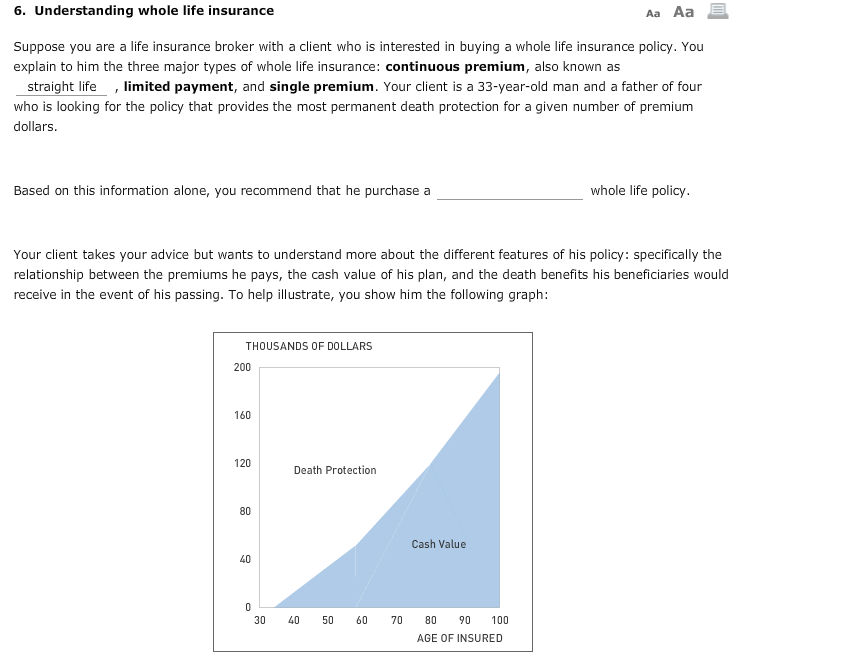

Solved 6 Understanding Whole Life Insurance Aa Aa Suppose Chegg Com

3 4 Whole Life Permanent Insurance

Whole Life Policies Flashcards Quizlet

Level Premium Term Life Insurance Policies Quizlet At Level

3 Life Insurance Policies Provisions Options And Riders Part A 15 Questions Flashcards Quizlet

2 15 License Chapter 2 Part 1 Flashcards Quizlet

Whole Life Policies Flashcards Quizlet

Life Insurance Chapter 2 Types Of Life Policies Flashcards Quizlet

Printable Sample Credit Reference Letter Form Reference Letter Reference Letter Template Cover Letter For Resume

Chapter 1 Types Of Individual Life Insurance Flashcards Quizlet

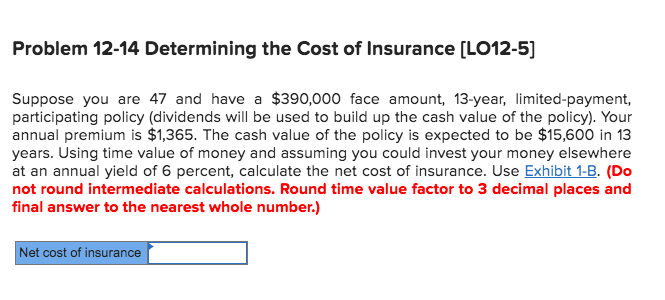

Solved Problem 12 14 Determining The Cost Of Insurance Chegg Com

Insurance Term Of The Day Limited Payment Whole Life Plan Life Cover Life Plan How To Plan

Personal Accident Policy Schedule How To Create A Personal Accident Policy Schedule Download This Personal Ac Schedule Templates Schedule Template Templates

Simple Alphabet Chart That Contains Both Uppercase And Lowercase Letters Alphabet Charts Alphabet Recognition Uppercase And Lowercase Letters

Proof Cellarpaper Co Throughout Ppi Claim Letter Template For Credit Card Cumed Org Letter Templates Lettering Credit Card Images

Renters Insurance Quizlet Best Health Insurance Healthcare Plan Health Insurance Coverage

Solved 6 Understanding Whole Life Insurance Aa Aa Suppose Chegg Com